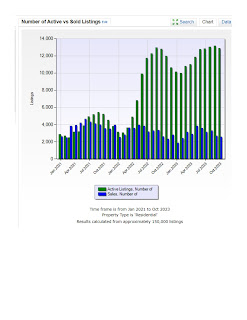

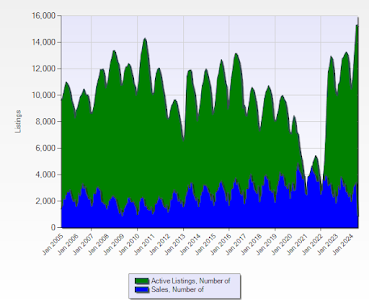

In Austin MLS, residential sales units sold in June were down 20% compared to June of 2023. Active listings of residential properties remain high at 15,414 units as of today. The number of active listings are increasing as interest rates remain above 6.5% (per Mortgage Daily 6.87% on 30 year fixed conventional on 7/12/2024).

In Lake Travis ISD, residential sales units sold are down 9% compared to last June. The number of active listings are at 763 today.

If you are considering buying or selling, contact me if this is a good time to buy/sell in Austin.

.png)